About us

OBAFRICA AM is a company

that invests in African listed companies.

OBAFRICA AM is a company based in Casablanca that invests in African listed companies.

OBAFRICA AM is a company based in Casablanca that invests in African listed companies.

OBAFRICA AM’s method is based on an in-depth knowledge of the listed companies. The fund managers meet with the management of these companies and also engage in solid valuation work.

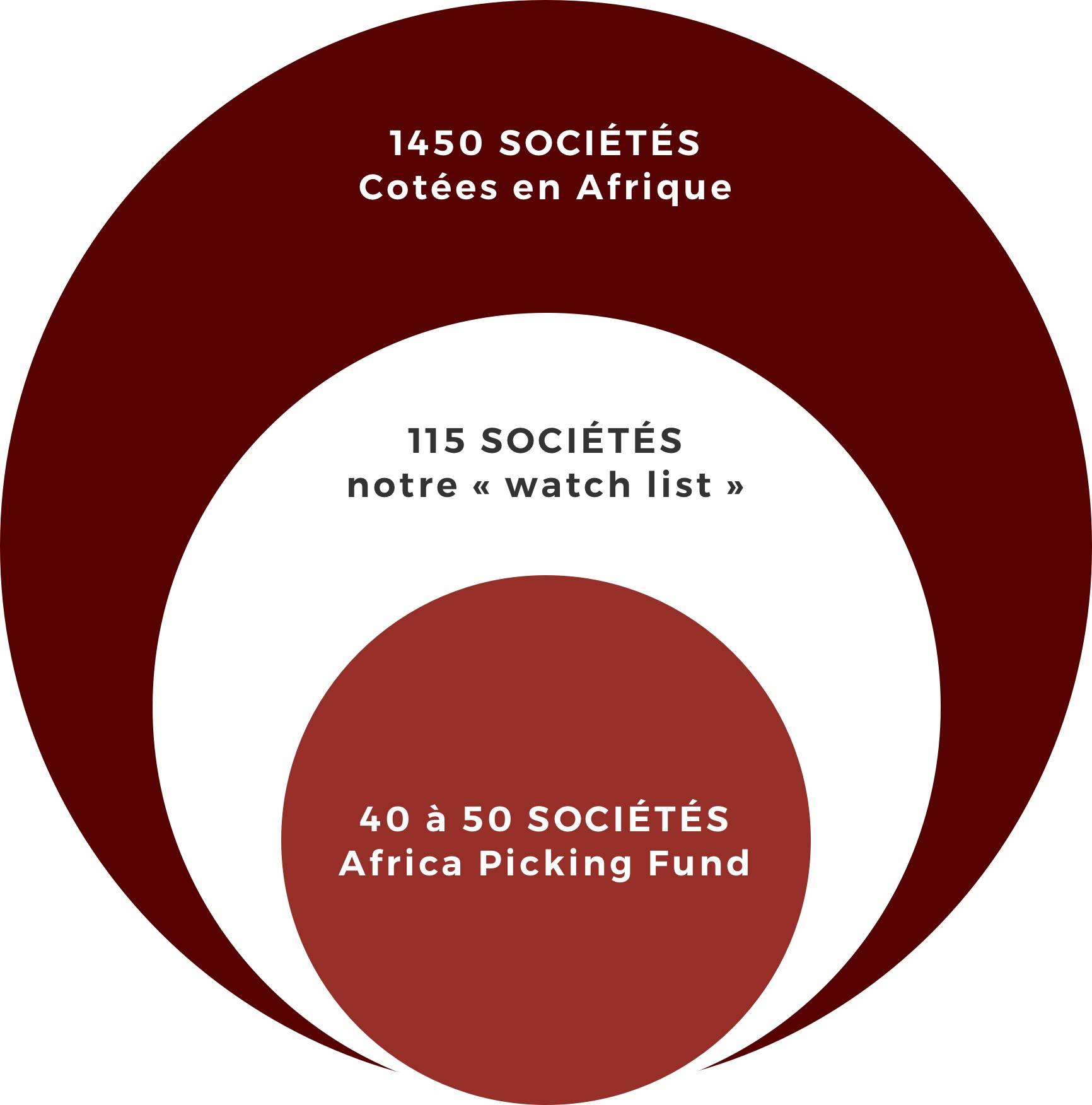

As the performance of companies is measured over a certain amount of time, OBAFRICA AM invests for the long term. OBAFRICA AM manages a mutual fund named AFRICA PICKING FUND with primary theme is to position itself to benefit from the increase in the wealth of African populations.

FINANCIERE DE L’ECHIQUIER, one of the largest private asset manager in France, is supporting OBAFRICA AM by offering its infrastructure to, risk control and internal control as well as its middle office. Thanks to this service agreement with FINANCIERE DE L’ECHIQUIER, OBAFRICA AM can focus on its two main objectives: the performance of AFRICA PICKING FUND and the growth in its assets under management.

OBAFRICA AM is one of the first Moroccan companies to have obtained the « Casablanca Finance City » status. This status is granted by the « Casablanca Finance City Authority » to financial companies that generate a significant portion of their revenues abroad and have pan-African ambitions.

Our investment philosophy is based on high-conviction ideas.

We use a thorough selection process to identify the companies we want in our portfolio:

In-depth knowledge: we only buy what we understand and we invest the capital of our clients only after meeting with the management

Fundamental analysis: for each companies, we set an entry price and a target exit price based on a comprehensive financial analysis done by our fund managers

We do not limit ourselves to a specific management style but we have a bias towards growth investing and we like companies with strong leadership and in position to create value over the long term.

We evaluate companies on a qualitative and a quantitative scale. Each company is assessed based on 3 criteria: quality of the management team, solidity of the financial structure and growth prospects.

Considering the specificities of African stock markets, we also look at liquidity, political and currency risks.

Quantitative criteria

Valuation metrics:

EV/Sales; EV/EBITDA, PE; P/B; P/CF…

Growth of revenue and results

Return on capital employed

Qualitative criteria

Competitive position

geographic exposure

(political risk/currency)

Management Quality

Quality and stability of the shareholding

Decision criteria

Minimum upside of 50%

Stock liquidity

Ouissem Barbouchi | President, Fund Manager

After a first experience in advisory at Accenture, Ouissem joins La Financière de l’Echiquier in 2007, working as an analyst. He worked as an SRI analyst for a year and then joined the value investing team.

In 2011, Ouissem spends 3 months in Shanghai to meet companies and look for investment opportunities.

This experience in an emerging market will inspire him to explore another area of fast growth: Africa.

With the backing of Financière de l’Echiquier, he co-founds OBAFRICA AM in 2014.

Ouissem Barbouchi graduated from Sciences Po Paris, Sup de Co Reims and also has a degree in philosophy.